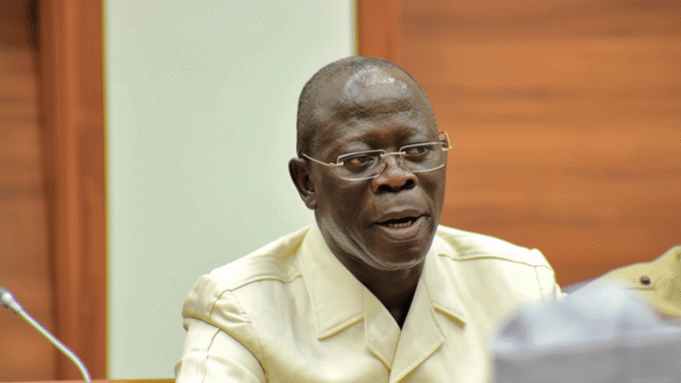

Senator representing Edo North, Adams Oshiomhole, has called on the Federal Government to jail tax evaders as a way of strengthening compliance and deterring others from violating tax laws.

Oshiomhole made the call on Wednesday while speaking on Channels Television’s Politics Today programme, where he argued that resistance to taxation, particularly value-added tax (VAT), is largely a Nigerian phenomenon.

According to him, the newly enacted tax laws are designed to protect low-income earners while ensuring that those who earn more contribute fairly to national revenue. He stressed that tax compliance should not be treated as optional.

“Taxes must be paid by those who are supposed to pay them and must be ruthlessly collected. It is not merely a civil obligation. Breaching tax laws is a criminal offence, and serious governments send offenders to prison when they refuse to pay or manipulate tax records,” Oshiomhole said.

The former Edo State governor explained that the current tax framework reflects the principles of a progressive system, placing a higher burden on high-income earners while shielding the poor.

He also clarified that VAT mainly applies to luxury and non-essential items, not basic goods, and criticised Nigerians who oppose paying local taxes but readily comply with similar obligations abroad.

Oshiomhole maintained that President Bola Tinubu’s tax reforms align with progressive governance, noting that exemptions are built into the system for those who earn less.

“This is a progressive tax policy that places a higher burden on those who earn more while offering relief to low-income earners,” he said.

He added that widespread misunderstanding of how government revenue works contributes to public resistance to taxation.

“Governments do not earn money on their own. Citizens earn income, and government revenue comes from taxes paid by individuals and corporations. These taxes determine the annual income of the state,” Oshiomhole explained.