Fresh corruption investigations involving senior officials who served under former President Muhammadu Buhari have thrown renewed attention on the governance record of his eight-year administration, with alleged financial infractions estimated at about N3.47 trillion.

The unfolding probes, coming against the backdrop of Nigeria’s heavy debt burden, have reignited national debates around accountability, fiscal discipline and the real cost of governance during Buhari’s tenure.

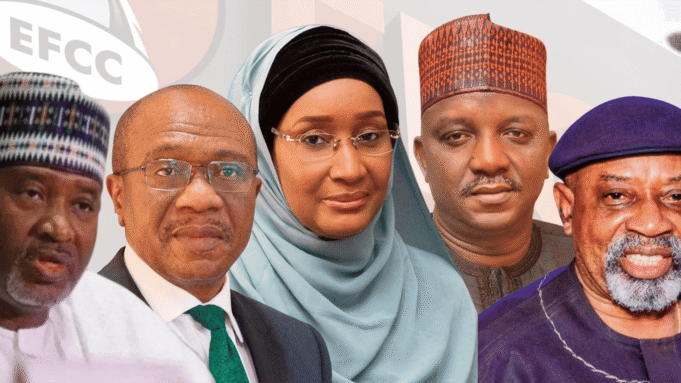

Those under investigation include former ministers, top government officials and the immediate past Governor of the Central Bank of Nigeria, many of whom were regarded as key figures within the All Progressives Congress (APC) government.

At the centre of the investigations is former CBN Governor Godwin Emefiele, whose tenure coincided with expansive monetary interventions and large-scale use of Ways and Means financing.

The Economic and Financial Crimes Commission (EFCC) has accused him of allocating foreign exchange worth about $2 billion, estimated at N3 trillion, without due process or competitive bidding, allegedly favouring associates.

Investigators also allege that Emefiele operated hundreds of bank accounts across multiple jurisdictions, illegally acquired a large housing estate in Abuja and mismanaged more than N16 billion in public funds.

Court documents further indicate that between 2019 and 2022, billions of naira were allegedly funnelled through proxy accounts linked to private companies, with additional claims involving forged requests for the payment of millions of dollars to foreign election observers.

Beyond the financial sector, the EFCC is pursuing cases against several former ministers.

Chris Ngige, a former Minister of Labour, is being investigated over an alleged N2.2 billion fraud.

Former Minister of State for Petroleum Resources, Timipre Sylva, has been declared wanted over claims of a N21.4 billion fraud, while former Aviation Minister Hadi Sirika is facing charges linked to an alleged N2.7 billion aviation contract scandal.

Also under prosecution is former Minister of Power, Saleh Mamman, who is standing trial for alleged money laundering amounting to N33.8 billion.

Similarly, the Ministry of Humanitarian Affairs, under former minister Sadiya Umar-Farouk, is accused of laundering N37 billion meant for social intervention programmes.

In direct naira terms, allegations against Buhari-era officials amount to about N471 billion.

When the disputed foreign exchange allocations are included, the figure rises to an estimated N3.47 trillion, underscoring the scale of the cases now confronting anti-graft agencies.

The investigations have drawn attention to Nigeria’s debt profile under Buhari.

When he assumed office in 2015, the country’s total debt stood at about $65.4 billion.

Although there was a slight decline in 2016, borrowing accelerated thereafter.

By 2019, total debt had risen to over $84 billion, reaching nearly $96 billion by mid-2021.

By the end of 2022, Nigeria’s debt had climbed to N46.25 trillion, with estimates suggesting Buhari handed over a total debt burden of roughly N77 trillion in May 2023.

Analysts argue that the corruption allegations cannot be separated from the borrowing spree.

While loans were justified as necessary for infrastructure and economic stabilisation, critics say weak oversight, opaque monetary policies and politicised spending created opportunities for abuse.

Supporters of the former administration, however, contend that many of the EFCC’s actions are politically driven and aimed at undermining Buhari’s anti-corruption credentials.

Economists and governance experts have raised broader concerns about Nigeria’s public finance architecture.

Professor Emmanuel Nwosu of the University of Nigeria, Nsukka, said allegations running into trillions of naira point to deep failures in accounting and auditing systems.

According to him, corruption on such a scale should be impossible if public financial controls were effective.

He also questioned the narrative surrounding fuel subsidy removal, noting the lack of transparency over how savings are being deployed despite persistently high petrol prices.

Public finance expert Prof. Chiwuike Uba warned that corruption involving borrowed funds places a long-term burden on citizens through inflation, higher taxes and declining public services.

He noted that despite increased revenues from subsidy removal and foreign exchange reforms, government borrowing continues to rise.

Similarly, Prof. Segun Ajibola, a former president of the Chartered Institute of Bankers of Nigeria, urged anti-corruption agencies to focus on large-scale financial crimes rather than minor offences, calling for tougher laws and citing China’s zero-tolerance approach as a model.

Other analysts, including Prof. Godwin Oyedokun, described the allegations as evidence of systemic failure rather than isolated misconduct, warning that future generations would bear the cost of debts incurred without corresponding development.

Legal practitioner Ameh Madaki criticised the EFCC for what he described as selective prosecution, arguing that many high-profile cases amount to media spectacles that rarely end in convictions.

Experts insist that Nigeria must move away from reactive, post-office investigations and adopt preventive mechanisms, including real-time auditing, transparent procurement processes and stronger institutional independence.

Without these reforms, they warn, the cycle of corruption, debt and underdevelopment will persist.